The 11.11 shopping festival has lost Taiwan consumer's hearts, but still has their wallets

Taiwan's equivalent of Black Friday is may be more low-key than before, but still the most important event in the Taiwan e-commerce calendar.

Summary

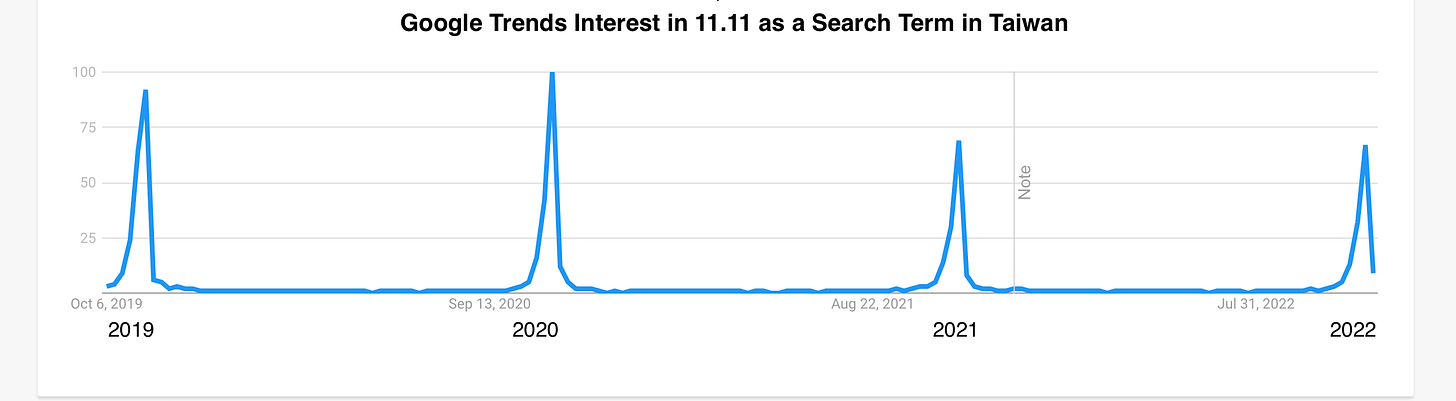

Consumer interest in the 11.11 e-commerce festival is at a record low. Google search traffic for the event is around 30% lower than the peak in 2019.

Surprisingly, all major e-commerce platforms reported stellar sales results. Shopee sold 10 million products in the first two hours and revenues on momo were 4.2x of an average day.

Strong sales in spite of a can be attributed in part to consumers choosing to hoard cut-price items in anticipation of coming inflation. 64% of Taiwanese shop tactically this way online.

11.11 has become the marquee event for Taiwan's e-commerce sector

Retailers in Taiwan engage in fierce competition to win customer spending for the Double 11(11.11) shopping festival that’s held on November 11th, also known as single’s day. It began in China in 2009 and then spread to Taiwan, as a day when online retailers entice shoppers with unbelievable discounts and price promotions.

e-commerce platforms invest a large percentage of their online advertising budget on the festival and it’s common to see platforms vie to outperform others with new gimmicks or live performances or appearances from top-tier celebrities.

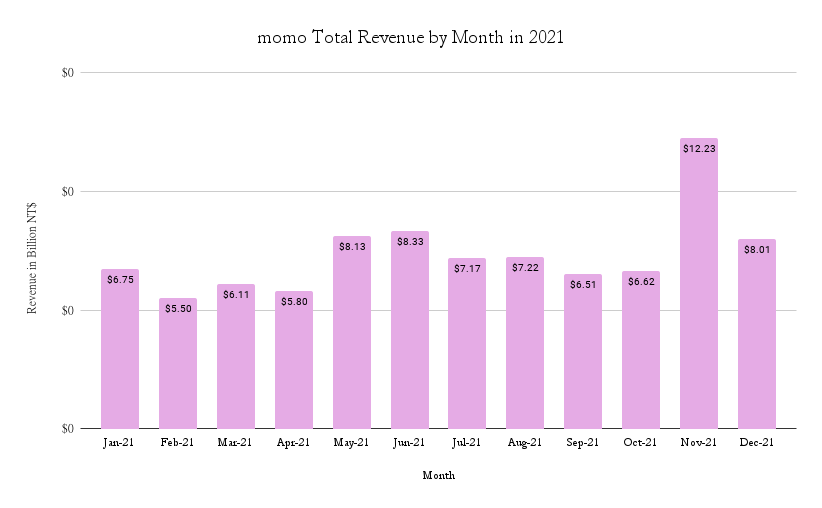

The event is also responsible for a significant percentage of annual revenues. For example, domestic champion momo reported revenues of NT$ 12.23 billion for November 2021, representing an 85% increase from the previous month and nearly 1.7X higher than the yearly monthly average.

Has Double 11 lost its magic?

Fervour for this year's 11.11 festival, has been noticeably lukewarm in comparison with previous years. There have been none of the celebrity-led events, like last year when Shoppee invited megastar singer Amei to be their ambassador. Google Trends shows that search interest in the festival is down close to 30% from its peak in 2019

‘Cold’ was the adjective that Chen Xianli, chairman of Taiwanese e-commerce consultant TeSA, used to describe consumers’ reception to the build-up to this year’s festival, in an interview for Commonwealth magazine.

These feelings were echoed by netizens on Dcard, an online forum popular with younger Taiwanese. A top post suggested that shoppers stayed away from 11.11 promotions altogether, as the promotions were often empty and inferior to the past.

“Double 11 is more and more not Double 11” - Dcard poster

Overview: 11.11 2022 sales actually surprisingly strong

Taiwan’s leading platforms, MOMO, Shoppe, and PCHome all reported impressive early results from 11.11

momo

In recent years, momo has been the most successful of Taiwan’s domestic e-commerce platforms and they hit new peaks for this year’s Double 11 festival.

In the first hour of the promotion(00:00~01:00), sales were 45% higher than the previous year. Revenues were 4.2 times higher than the daily average for the platform. The categories with the highest revenues for the promotion were 3C home appliances, household cleaning, and baby products.

Shoppee

Shopee reported selling more than 10 million items within the first two hours of the event, 11x what is sold on an average day.

Shopee attributed these excellent results to free delivery and 15% discount coupons distributed before the event. Consumers waited till Double 11 to clear out a list of items that had been piling up in their shopping carts.

PChome

The ‘Grand Old Lady’ of Taiwan digital retail, PChome also performed well, driven by an aggressive discount strategy.

The day before the festival, Pchome reported a 25% increase in site traffic over 2021 and 50% higher revenues.

Question: If consumers don’t seem to care, why are they still spending on 11.11?

Reception to Double 11 is becoming lukewarm, but all major e-commerce platforms reported decent sales.

One explanation for this is that consumers are anticipating significant inflation and are looking to stock up on bargains before prices go up. A survey from the think-tank, Market Intelligence & Consulting Institute, found that since 2021, 64% of Taiwanese consumers reported engaged in tactical shopping behavior (stocking up on items when they are cheap online). Consumers in Taiwan are generally practical and price-sensitive.

Another reason is that 11.11 has replaced department store anniversary events as the time to buy something in Taiwan. COVID has shifted shopping behaviors to e-commerce, and 11.11 purchases are a matter of habit.