The 10-Year Formosa Fitness Frenzy: Why Taiwan Went Wild for Exercise

And also why chicken breast meat is now more expensive than chicken leg

Key Takeaways

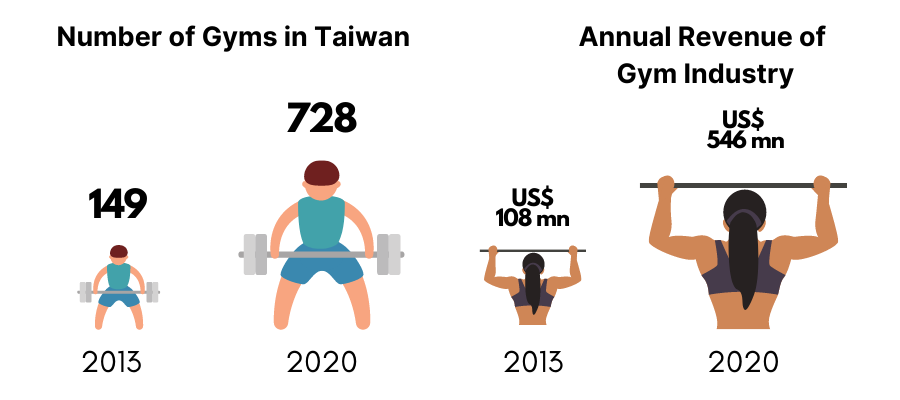

Taiwan has experienced a decade-long fitness boom, resulting in gym revenues increasing by 406% between 2013 and 2020.

Drivers for change include government, globalization, fitness being embraced by local celebrities, and the marketing success of overseas brands.

Women now lead fitness consumption in Taiwan and spend 1.8X as much on fitness as men.

2021 COVID restrictions, hit the gym industry hard, and people have switched to other fitness activities such as hiking, with no plans to return to gyms.

To capture rising fitness spending, brands need to discount aggressively and have strong influencer and localized marketing strategies.

Fitness and the Price of Chicken

Taiwan cuisine favors chicken legs over chicken breasts. Chicken leg meat is prized for having a higher fat content, and in general, being more flavorsome. Surprisingly, at the end of 2020, a report came out in the newspaper Apple Daily announcing that the price of chicken breasts was set to surpass that of chicken legs.

What had brought about this reversal of entrenched traditional dietary preferences? Most pointed to a decade-long fitness boom and a new awareness of nutrition and the necessity of protein for muscle building. Simply put, Taiwanese care more about being fit and healthy than they did in past and to such an extent that it had started to influence grocery prices.

The Taiwan Fitness Boom

The aforementioned changes in chicken prices can be attributed to widespread changes in the number of people involved in fitness lifestyles and consuming fitness in Taiwan. This is supported by data from the Ministry of Finance, for example, only 149 gyms were operating in Taiwan in 2013, and that number rose to 728 in 2020. If we look at fitness spending, we can see that the annual revenue for the gym industry was around NT$3 billion (US$108 million) in 2013, which increased significantly to NT$15.2 billion (US$546 million) by 2020, with a compound annual growth rate (CAGR) of 22.4% over that period.

Taiwanese have progressively developed stronger fitness habits over the last decade, to the point that fitness activities have become mainstream. Data from GO SURVEY shows that in 2021, 56.9% of Taiwanese now exercise two or more times a week and 24.8% three or more times, with 23% exercising every day.

Consumers aged between the ages of 20-39 are most likely to go to the gym, with 60% expressing that they had visited a gym at least once in the last year (Source: Taiwan Trends Gym Survey 2021). The average monthly expenditure on fitness by consumers in Taiwan is NT$ 2406(US$86) per month.

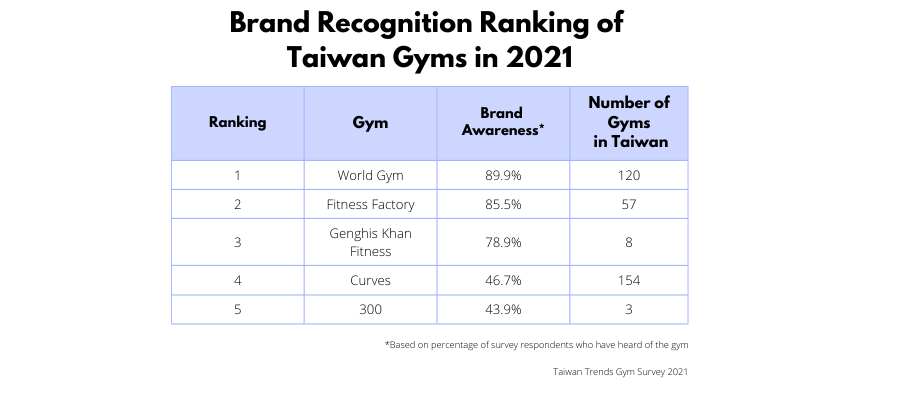

The leading names in the gym and fitness industry in Taiwan in terms of brand recognition are World Gym, Fitness Factory and the Genghis Khan Gym(成吉思汗健身俱樂部), Curves and 300(300 壯士). World Gym is the most well-known gym brand in Taiwan and by some margin, has the most locations of all the big box gyms in the country. While once the undisputed leader in the fitness industry in Taiwan, World Gym has acquired a somewhat poor reputation for aggressive and predatory membership contract practices in which members were locked into long-term inescapable agreements. Fitness Factory has shown strong revenues in the last few years and was the first gym in Taiwan to IPO.

Genghis Khan Gym(成吉思汗健身俱樂部), third in the list is a real recent local success story driven by the personality of its celebrity owner, Holger Chen(陳之漢), popularly known as Guan Zhang (館長, literally meaning gym manager). Chen has built a reputation in Taiwan as a straight-talking, ex-gangster vlogger and entrepreneur and for his dedication to bodybuilding and fitness. He has also his own Notorious range of products and an army of younger followers.

Drivers for Cultural Change

Fitness as a paid leisure activity is relatively new and foreign in Taiwan. It has only really become mainstream as a result of the Taiwan economic miracle which set the conditions for consumerism and more time for leisure and lifestyles.

If we look at Taiwan's modern history, practices related to fitness and sports in terms of how we view them today were first developed in the era of Japanese colonization and a colonial education system that pushed the principle that a disciplined body was needed to meet the interests of the country. From the 1950s, the Kuomintang regime replicated the Japanese, by linking sports and physical strength to the national rejuvenation project. These types of sports and fitness behaviors were thus linked to authoritarianism and nationalism, rather than lifestyles or individual choice. It was not until the late eighties and the shifting tides of democratization that lifestyle fitness in its present form, entered into the popular consciousness.

In the past, Taiwanese thought of fitness as something for the moneyed leisure class or people who had athletic backgrounds. Traditionally the forms of fitness practices engaged in by Taiwanese were free, such as Tai Chi or martial arts in parks or public areas.

As outlined in the first section, all of this has now changed, and the popular mindset is that fitness is open and beneficial to all. The reasons for this cultural shift are outlined below:

Government Schemes and Policy

In 2010, the government launched the iSports program (i運動) to encourage sports and fitness habits in the general population. Through this scheme, the government has pushed the idea that sport and fitness are beneficial for everyone, and made it easier and cheaper to participate in. From this point on the national consciousness has changed to begin to view health and fitness as being essential to a long and happy life.

The most successful of the initiatives that fall under the umbrella of the scheme has been the creation of national government-run municipal gyms. Typically, these gyms offer a full range of sports and fitness activities including tennis courts, swimming pools, and gyms. The price for an hour-long workout is capped at NT$ 50, making it affordable to all strata of society and lowering the barriers to entry for fitness in Taiwan. According to 2021 research data from Taiwan Trend Research, 57.2% of people choose to exercise in municipal gyms because of the low pricing.

Another government-led policy direction that has helped to increase fitness participation, has been a crackdown on predatory and unclear contract practices, especially in the case of the most egregious party, World Gym. Since the involvement of a watchdog, gyms are no longer able to pressure members to buy personal trainer classes or make it unnecessarily difficult to get out of contracts.

Globalization and the Media

Modern fitness culture in Taiwan, in terms of gym-going and fitness classes, was once considered something foreign and exotic. Gym culture became mainstream in Taiwan, with the entrance into the market of the US-based chain, California fitness, which opened its first branch in Taipei in 2002. At the time, going to gyms was new and seen as high status and cosmopolitan.

This type of symbolic fitness consumption still exists today, but the symbolism has altered with a changing society. Symbolic staus is now attached to newer and often pricier classes such as pole-dancing, cross-fit, and MMA.

In an ultra-competitive and status-obsessed society like metropolitan Taiwan, in the last decade, being fit and healthy has become considered a symbol of being a successful person. The modern business class is now required to engage in fitness consumption and to attain a specific body type, to attain the status of being an accomplished person.

Media and celebrities have also driven the adoption of fitness consumption practices in Taiwan. In the last two decades, celebrities have associated themselves with fitness lifestyles. For example, megastar Jay Chou invested in a chain of gyms in Northern Taiwan. These celebrity endorsements served to push new body ideals (that physical fitness was desirable) and the notion that going to gyms was a high-status activity.

Social media and the ascendancy of internet celebrities into the nation’s consciousness have also furthered the status of fitness culture and associated body ideals. Some of the most popular influencers in Taiwan on social media platforms like Instagram and Tiktok are those related to fitness.

The Success of Of Foreign Brands Marketing Efforts

“You can say that the Taiwan fitness industry has developed in unison with the success of Nike in Taiwan”- Ray Liu, Founder of LinkSports

The other commanding factor in the growth of fitness culture in Taiwan should be attributed to overseas brands, who have been extremely successful in packaging fitness lifestyles to Taiwan consumers. According to Ray Liu, founder of the Taiwan sports industry think-tank, LinkSports, “the Taiwan fitness industry has developed in unison with the success of Nike in Taiwan”. Ray believes that it is Nike’s innovative campaigns that were the engine for the popularity of running as an activity in the 90s and they have been similarly responsible for most of the concurrent fitness trends in Taiwan after that. Adidas and a few other brands have also enjoyed similar success in packaging fitness as something fashionable and desirable.

Why Women Now Power Fitness Consumption in Taiwan

The rise of female fitness consumption is perhaps the most significant change in the fitness industry over the last decade. According to government data, In 2013 the percentage of women who regularly engaged in sports and fitness was 27%, which rose significantly to 30.4% in 2019. In comparison, male fitness involvement has barely changed, in 2013 35.6% of men exercised regularly, and this number only increased to 36.7% by 2019.

While male fitness consumers still outnumber women in Taiwan, women spend considerably more on fitness than men. In 2019, the total national fitness activity expenditure by women was NT$ 7.51 billion (US$269 million), which was 1.8x higher than the male spend of NT$ 4.24 billion (US$152 million). 16.4% of female consumers will purchase exercise classes of some sort in a year, compared to only 9% of men and 4.3% of women will pay for a personal trainer, which only 3.1% of men are willing to do.

Why are women now involved more in fitness and spending more on fitness? Professor of the Sociology of Sports, Ying Chiang, of Chihlee University of Technology thinks that the main reason is a change in the way that Taiwanese view femininity and gender roles. Before the 1990s, Women’s status in society was always connected to the home and being a mother. Docility was considered to be an expression of femininity. Women at the time had minimal consumption power and little leisure time to engage in fitness activities.

With the substantiative growth of the Taiwanese economy at the end of the 80s and ’90s, the conditions were put in place for Taiwanese to embrace both consumerism and leisure lifestyles. At the beginning of the 1990s, Taiwan became influenced by an already established Western fitness culture, that had blossomed through celebrity workout videos from stars like Olivia Newton-John and Cindy Crawford. This also introduced a new set of female body ideals, which told women that it was feminine and attractive to be lean, muscular, and healthy.

These changes were amplified as women’s status and power in society grew in the following decades and engendered the current paradigm in which being fit is now an expression of feminity. Women are now getting married later, having fewer children, and having more leisure time for lifestyles such as fitness. In this way, fitness consumption has become a representation of modern female empowerment, showing that a woman is both strong and independent.

“At one level the rise of Taiwanese female fitness consumption represents female empowerment, but at another level, it’s just a repackaging of the traditional Taiwan beauty myth”-Professor Ying Chiang, Chilhee University

Professor Chiang also highlights that there a limits to this model of empowerment and in many ways, it is very much a new manifestation of entrenched beauty myths. The main reason that women go to gyms and get fit, is still to lose weight to satisfy the ‘male gaze’. Women are still striving to achieve an ideal body that meets a singular societal definition. The only difference is that this body ideal is fitter and more muscular than before.

As a reflection of this, female fitness KOL are far more influential and generate more sales than their male counterparts(and are consequently more expensive for brands). Women are more pressured to match the beauty ideals represented by these influencers. As many women are new to fitness, they are often the source for women to learn about fitness lifestyle and they have a lot of power over female fitness consumers. When women are at the information-gathering stage when they decide to get fit, influencers are often the main source of knowledge and can be seen as gatekeepers to fitness culture.

The brand Nike should also be attributed in many ways for the rise of female fitness consumption, according to Ray Liu of LinkSports. Nike has been extremely active in promoting fitness activities for women and packing fitness lifestyles in a way that is attractive to professional women. Most of Nike’s offline events and promotions are female-focused, as recognition for the potential of that market. From the mid-90s, Nike devised women-led marketing campaigns and slogans that were designed to specifically connect with female consumers in Taiwan and present fitness as something that was both attractive and accessible. The most prominent of these was when in 2007, Nike worked with three film directors to produce a film called “She JUST DO IT”(她 JUST DO IT) in which three different women told emphasized in stories the need to break through limitations and develop one’s talents. The film was entered into the country’s Golden Horse Film Festival and was praised for stressing the importance of self-realization and internal beauty, over physical appearance.

The Effect of the COVID Pandemic on Taiwan Fitness Consumption

The COVID pandemic has made in Taiwan people pay more attention to their health, and more people are exercising than before. These were the findings from a 2021 study commissioned by the Sports Administration (教育部體育署) and undertaken by Shih Hsin University(世新大學). Despite Taiwan having a major COVID outbreak in May 2021 and implementing lockdown-style restrictions that lasted until September, the percentage of the population who regularly exercised reached 33.9%, which was an increase of 0.9% over the previous year.

While the global market for sporting goods and apparel has been strong, growth in Taiwan has been relatively stagnant. The biggest change has been the wider adoption of online sales for fitness products. In 2020, as the COVID pandemic broke out in Taiwan, offline sales fell in the first two quarters of the year, while online sales grew by 5.19% and 19.10%. In total, online sales for fitness products grew by 18.97% for the year.

Gyms have been majorly impacted by the outbreak in Taiwan in May 2021, which forced them to close for months. The number of gyms in Taiwan and memberships had been growing up to that point, but after the restrictions and their subsequent easing, it appears that many old members are not returning, and new memberships are stagnant. Revenues for the True Yoga Group, which runs 40 gyms in Taiwan (including the True Fitness chain), were down 14.8% in the first six months of 2021 when compared with the previous year. Fitness Factory showed a 5% YOY decrease in revenues in the 4th quarter of 2021.

Ray Liu of LinkSports thinks that the growth of gyms will be stagnant in Taiwan, moving forward. “After the COVID outbreak, lot of people think they now don’t need to go to gyms”, explains Liu, “They now have acquired replacement fitness activities such as swimming, hiking, free-diving, or other outdoor activities and have no plan to return to gyms”.

Building a home gym, a trend that has been common for decades in Western countries has now really picked up speed in Taiwan thanks to the COVID pandemic. A dedicated Facebook group has over 30,000 members who share knowledge and tips on building your home gym. Many opt for importing equipment from Chinese merchants on the platform Taobao, as the costs are lower than buying domestically.

How to Succeed in Taiwan Fitness Market

There is a conversion that fitness consumption will only increase in Taiwan in the following decade, but how can brands catch this rising opportunity?

The Role of Fitness in Taiwan

To connect with Taiwanese consumers, it’s important to understand the meanings attributed to fitness. Ray Liu of LinkSports, explains that for many younger Taiwanese, gyms and fitness activities are seen often as opportunities for socializing. Many people visit gyms to spend time with friends, family, or coworkers, while others see group classes as an opportunity to meet new people. Taiwanese make decisions to buy apparel based on whether it’s fashionable or cool, rather than for functionality.

Fitness is also very much a status activity. Professor Ying Chiang believes that while fitness culture is growing across Taiwan, it is mostly centralized in the metropolitan areas. People consider that by going to a more expensive gym or a sought-after personal trainer, they will be considered higher class. The same goes for more expensive group classes or fitness apparel.

“Taiwan Tinder profiles show that people view fitness lifestyles as a sign of accomplishment and worldliness”-Professor Ying Chiang, Chilhee University

Being fit and involved in fitness lifestyles is also now considered a marker that someone is independent and globalized. Professor Chiang adds that “you only have to look at Tinder in Taiwan to see the number of photos of people working out, this is a representation of the self as accomplished and cosmopolitan”.

Pricing Strategy for Taiwan

When pricing for the Taiwan market, it’s important to know that Taiwanese are very price-conscious and discount-driven. Adidas and Nike have aggressive discounting policies and it’s common for even a new product to be heavily discounted when it hits the stores.

At the same time, many Taiwanese have high spending power and are willing to spend considerable amounts of money on their lifestyles and hobbies. It is common for Nike’s most expensive running shoes to be completely out of stock in Taiwan, and with long waiting lists.

Marketing Fitness to Taiwanese Consumers

Taiwanese consumers are very willing to buy new brands and products if they are recommended to them by an influencer, or a Korean/Hollywood celebrity. Thus, the Taiwan fitness market can be seen to be more influencer-driven than elsewhere. Les Mills, the most successful brand of fitness classes in Taiwan, has prospered by fostering a team of celebrity instructors with legions of fans who want to come to their classes.

At the same time, you still need to embrace more traditional marketing channels. “If you only invest in KOL marketing, people will see you as a fad KOL brand, and of lower status”, explains Ray Liu of LinkSports.

The most important digital marketing channel for fitness brands is Instagram, followed by Tiktok. Facebook, like elsewhere, is now considered an older and less fashionable platform. Livestreaming E-Commerce is popular in Taiwan, but it is seen as low status and not suitable for premium products.

Localization

Many overseas brands struggle in Taiwan they because just rehash marketing campaigns designed for the China market. They fail to understand and respect the differences between the consumers, and will just replicate marketing efforts to save money. There is a misapprehension that because it’s all in Chinese, the Taiwanese will accept it. In fact, the Taiwanese are very sensitive to when a campaign slogan or visual was originally made for the China market.

Taiwan is a mature market. Indeed, consumers like foreign brands, but they respond positively when they feel that brands have made an effort to listen to Taiwanese and develop localized marketing campaigns. Particularly well received is when brands are willing to provide exclusive products or invite superstars to visit Taiwan.

Nike excel at this, they have a branch office in Taiwan and develop local campaigns that resonate with local consumers. They also sponsor a lot of sporting events and local competitions. In comparison, Under Armor, which lost a lot of market share since 2018, has done relatively poorly in this regard.

There is also an opportunity for more niche brands if they can connect to the smaller interest groups. Zwift, the home cycling virtual training APP, has been very successful in Taiwan, because of targeted campaigns and content that were tailored for the Taiwanese road cycling community.

Future Trends & Opportunities

Inclusivity

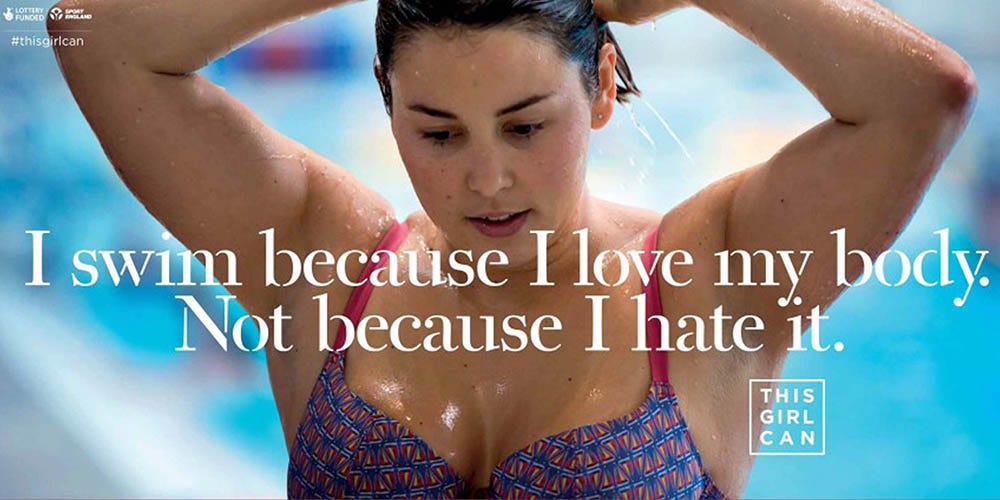

There is an opportunity for more inclusive forms of fitness marketing, as the ‘THIS GIRL CAN’ campaign in the UK Fitness in Taiwan is very much marketed as an activity for the beautiful and successful, especially when female fitness. Professor Yang Jiang sees an opportunity for brands that promote inclusivity and diversity of body types in their marketing, like the successful ‘THIS GIRL CAN’ campaign in the UK. Many women in Taiwan do not fulfill traditional body stereotypes and are not being catered to by brands.

Hybrid Fitness

When the COVID pandemic hit Taiwan in May of 2021, consumers didn’t embrace working out at home, like in the Western world. According to fitness industry consultant, Amber Hsu, this is because “Taiwanese homes are small, and people are not as malleable when it comes to fitness as elsewhere”. Also, the social factor of fitness classes is part of their appeal, especially for female consumers, and this is hard to replicate online.

What is likely to grow in the next decade, is more of a hybrid form of fitness, which caters to both the convenience of exercising at home, while still allowing people to enjoy the social aspects of working out in the gym or a class. In Taiwan, you will start to see a lot of higher-quality, paid fitness content from coaches with strong social media followings.Physical Retail to Become Experience-Led

Taiwanese E-Commerce boomed as a result of the pandemic, and it will increasingly take a larger share of fitness apparel and accessory sales.

As the market shifts to larger online sales, the role of the physical store will be more like an experience center in which consumers can primarily learn and interact with the brand and its products.Silver-Haired Fitness

Taiwan has one of the oldest populations in the world, and to reduce the burden on the national insurance system, the government has been emphasizing the importance of exercise for older people. Older consumers in Taiwan also have significant, untapped consumption power.

Expect to see more gyms and clubs targeted to older consumers in the next decade. There is also a big opportunity for apparel and accessories brands that can successfully target this segment.