Who Are Taiwan's Luxury Consumers?

An analysis of profiles, preferences and behaviors of luxury consumers in Taiwan

Taiwanese Are Among the Biggest Luxury Spenders in Asia

Taiwanese consumers have emerged as the highest per-capita spenders on luxury goods in East Asia, spending approximately US$342 per person. This amount exceeds the spending of both Japanese (by nearly US$150) and American nationals (US$280). The Taiwan luxury market, valued at $8.1 billion, has crept up in the last few years as one of the regional growth markets for luxury, surpassing Hong Kong in 2021.

This article takes a deep dive into the consumers that drive Taiwan’s impressive luxury growth. In researching the article, I spoke to luxury expert and former Editor-in-Chief of Prestige Taiwan, Monica Yang Shteinberg, and Don Lin, Director of Brand & Fashion Management at Fu Jen Catholic University.

How Did Taiwan’s Luxury Market Grow to Be So Strong?

The luxury market in Taiwan grew as a result of the Taiwan miracle, which reached its crescendo in the late 80’s and early 90’s. During this time, an affluent class arose in Taiwan, looking to use luxury products to show social status. Many luxury brands moved to Taiwan at this time and set up regional offices in Taipei.

As the market developed and matured in Taiwan, it was often Taiwanese individuals who played a crucial role in opening up the market in China for luxury brands. Today, Taiwan has emerged as one of the most affluent societies in Asia, boasting the highest net financial assets per capita in the region, making it a key market for the luxury industry.

4 Key Taiwan Luxury Consumer Personas

1. Young HENRYs (Age 25-35)

The first group is the Young HENRYs (High Earners, Not Rich Yet). These professionals are part of the Gen-Z or millennial generation and are on a trajectory of upward mobility. They have found success in well-paid career paths, such as in the semiconductor or finance industry, or they are young entrepreneurs. As they have achieved a certain level of affluence, they now have discretionary income to start purchasing luxury products.

These consumers tend to gravitate towards what would be considered entry-level luxury (affordable products at lower price points) and are more price-conscious than other luxury consumers. Female consumers like to purchase classic entry-level luxury bags like the Chanel Mini or Pouch, which are seen as a gateway into a brand that holds dream-like status for many young Taiwanese women.

Young HENRY's main motivation for buying luxury products is to display their unique style and taste. Gucci is a brand that is popular among these younger consumers because of the way they have consistently pushed boundaries and blurred the lines between gender, tradition, and modernity.

Location: Usually in Taipei, New Taipei, or Hsinchu. Metropolitan areas with the most high-paying white-collar jobs

Preferred brands: Gucci, Chanel, Louis Vuitton, and Off-White

Recommended messaging and marketing: Younger consumers are digitally native and primarily seek information on luxury and fashion online, meaning that brands need to invest in an innovative digital strategy.

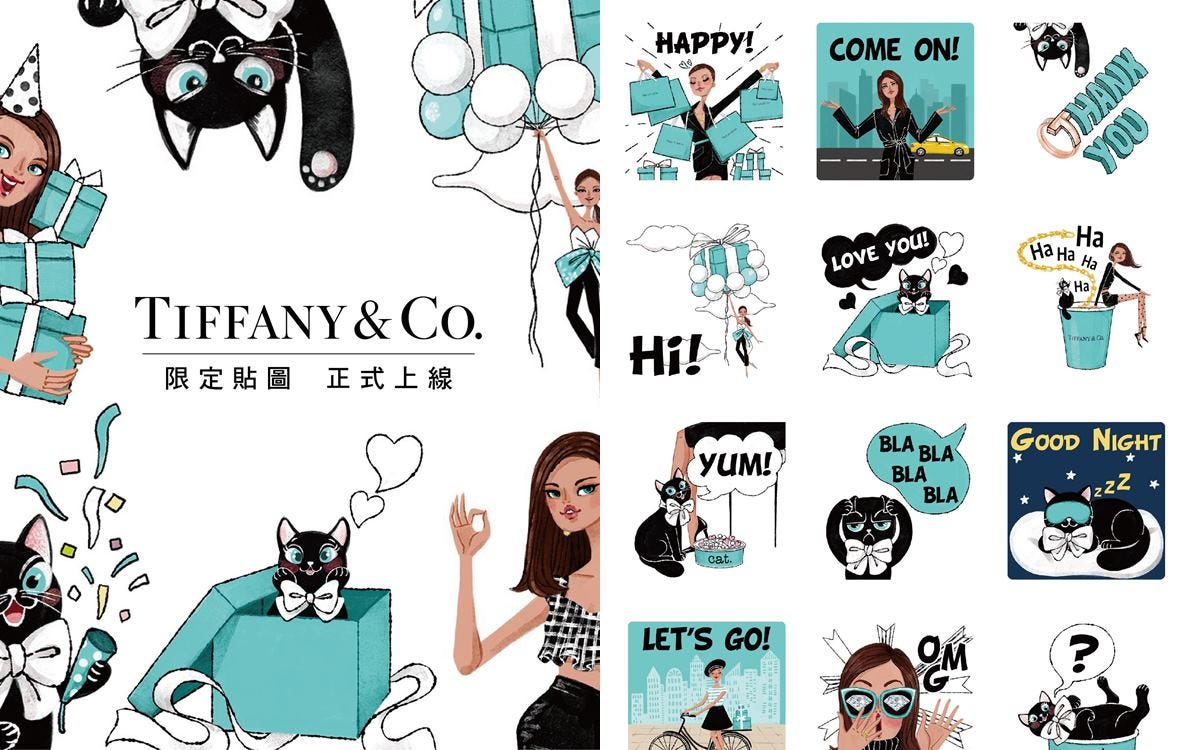

Among the various channels available, Instagram stands out as the most important platform to connect with these consumers. Additionally, many brands have found success by implementing LINE strategies and initiatives, particularly through official accounts. For instance, Tiffany created a popular sticker set, and Hermès launched a well-received astrology game.

2nd-Generation Affluent/富二代 (Age 25–40)

富二代 or 2nd-generation Affluent refers to the wealthy children of the business class who led Taiwan's economic miracle from the 1970s to the 1990s. They are often known for their extravagant display of wealth, attending lavish parties, and engaging in ostentatious behavior.

They have been around luxury goods since a young age, resulting in a deep understanding of brands and their products. As a result, they tend to be more fashion-forward compared to other consumers, and they strive to align their personal style with their lifestyle.

Additionally, they have a lot of social obligations and are constantly found attending parties and exclusive events. Consequently, they may feel a sense of pressure to stay up-to-date with the latest trends and to continually prove their sense of taste to peers.

Location: Taipei

Preferred brands: Balenciaga, Prada, and Dior

Recommended messaging and marketing: 2nd Gens love to be on the cusp of the current wave of coolness. Dior, despite being more of a classic brand, has resonated with these consumers through initiatives like partnering with K-Pop star Jisoo(of Blackpink).

2nd Gens are fundamentally social creatures, and brands can win their hearts by holding upscale, boundary-pushing events.

Classically Stylish (Age 35–50)

This group is made up of older professionals who have already acquired significant wealth and are financially stable. These consumers care more about classic and stylish products than what is fashionable, and they especially value excellent craftsmanship.

Classically stylish consumers take a lot of pride in what they have achieved in their lives and often buy luxury products as a way to reward themselves for their success. They are more focused on their internal image and how products make them feel about themselves. At the same time, although these consumers are generally wary of being seen as too showy, they often attend events where they feel obliged to showcase their luxury items to their peers.

Location: Taipei, New Taipei, or Hsinchu.

Preferred brands: Hermès, Rolex, Patek Philippe, and Chanel

Recommended marketing and messaging: These consumers will engage with social media and digital channels but primarily go to boutiques to research products and make purchases. They very much value relationships with a brand’s sales advisors, whom they go to for advice on what to buy.

Brands can effectively engage with this group through VIP events, particularly if they are exclusive and limited in size. Create a VIP name list and potentially utilize a dedicated marketing agency to help reach this audience.

Messaging needs to be understated and focus on lifestyle aspects rather than the products themselves.

Silver-Haired Wealthy (Age 50+)

The Silver-Haired Wealthy (SHW) are the pioneers of Taiwan's golden economic age and the wealthiest consumers in the country. Many are retirees, meaning they have both ample time and financial resources. Price is not a concern for SHW, and they absolutely belong in the top global tier of luxury consumers.

They are searching for sophisticated, high-quality items, particularly watches and jewelry. They prefer classic styles and show little interest in trends. Some classic collections, like Louis Vuitton’s Monogram, are eternal favorites with SHW.

Many SHW have long-term relationships with their favorite luxury brands, to which they are extremely loyal. In return, they expect these brands to offer them exclusive products.

SHW often have plans to pass on luxury items to their children. Therefore, they are attracted to products that can retain value or have potential as investments.

A subset of this group consists of the Fu Tai Tai(富太太), the rich wives of wealthy businessmen. They often form high-society cliques that frequently attend social events and actively participate in philanthropic organizations and their events.

These women experience significant pressure to maintain their appearance and compete with their peers in society. Luxury purchases are often used as a preferred method to achieve this, making them a priority target for luxury brands, and many brands clamor to get them on the guest list for their events.

Location: Anywhere. The consumers tend to be owners of factories or manufacturing-related businesses, which can be found across the country.

Preferred brands: Bulgari, Cartier, Patek Philippe, Louis Vuitton, and Piaget

Recommended marketing and messaging: SHW often already have established VIP relationships with their preferred brands. They exclusively shop in boutiques and do not make online purchases.

The most effective approach for brands to connect with SHW is through VIP events and gala dinners. Brands will often reach out to fashion media to access their customer lists for this purpose.

Where do Taiwanese Buy Luxury Products?

Physical retail (boutiques and department stores) is the most important luxury retail channel in Taiwan. Don Lin estimates that 85% of retail purchases in Taiwan occur in boutiques.

Wealthy customers in Taiwan highly value high-quality and personalized service. Sales advisors at Luxury Brand maintain close relationships with their VIP clients, who stay in constant contact with them through the messaging app LINE. The customer journey for older consumers tends to be lengthy, and they require a significant amount of information and guidance before making purchases.

Luxury e-commerce is really only a consideration for the under-40’s, and when they do buy online, it is from domestic platforms such as IFCHIC. Import taxes are high in Taiwan, so cross-border luxury platforms like Farfetch don’t make sense price-wise for most shoppers.

![購物教學] 精品電商IFCHIC,全球精品免運直送台灣!MARC JACOBS托特包開箱分享@ 哈娜Hanna S. :: 痞客邦:: 購物教學] 精品電商IFCHIC,全球精品免運直送台灣!MARC JACOBS托特包開箱分享@ 哈娜Hanna S. :: 痞客邦::](https://substackcdn.com/image/fetch/$s_!HnBG!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff21b35fb-2c9a-4d19-b7fe-54a1a26f0da5_1024x501.jpeg)

It is also common for Taiwanese to go overseas for luxury shopping, with Japan being the favored location, especially since the exchange rate is favorable at the moment and they can get a tax rebate.

Moreover, Japan leads Taiwan’s second-hand luxury market, especially for watches and high-ticket items such as Hermès bags. Taiwanese (particularly in the case of older consumers) have a special relationship with Japan, and Japanese sellers are regarded as being trustworthy, honest, and giving impeccable advice. Taiwanese in general are very risk-averse and worry about being cheated, and it can be said that they trust the Japanese even more than themselves. As well as traveling to Japan, they purchase from Japanese cross-border platforms, like watch specialists Jackroad, which, as mentioned previously, is something they don’t often do.

How Do Consumers Research and Learn About Luxury?

Digitally savvy younger consumers learn and research luxury from magazines like Elle, Vogue, or local bloggers. Cross-border sites like Farfetch and Mytheresa are popular for researching products.

Influencers are becoming less effective as a marketing channel for luxury brands in Taiwan. According to Monica Yang, "Ten years ago, brands were eager to collaborate with influencers, but now they are less enthusiastic and believe that influencers won't generate actual sales." She added, "One reason is that luxury consumers don’t trust influencers in the same way now, apart from with cosmetics and beauty products, which are an outlier.”

Physical stores and relationships with sales advisors remain the primary channels through which older consumers learn about and engage with their favorite brands and products. Sales advisors need to possess excellent communication skills because Taiwanese consumers place great importance on factors such as politeness, attitude, and using the appropriate communication style.

How to Win Taiwanese Luxury Consumers

I asked the interviewees what advice they would give to overseas brands who either have not entered the market or would like to expand their presence in Taiwan.

Tell a Compelling Story

Taiwanese people appreciate a good story, and it’s especially impactful when a brand develops a compelling narrative around its products or its mission. For instance, brands can highlight their philanthropic efforts or contributions to Taiwanese society. Alternatively, they can showcase the history of their brand and how they maintain quality standards.

Give a Perception of Value

The bottom line is that the Taiwanese care a lot about price performance (CP值), no matter if they are buying a bowl of noodles or a Swiss timepiece. Consumers in Taiwan hate the feeling that they have overpaid or are not getting good value. They certainly have the means and inclination to splash on luxury products, but brands will do well in their messaging to focus on the excellent quality of their products and give consumers the perception that they are getting their money’s worth.Be Understated but Special

Taiwan is a mature market, and consumers are very conscious about appearing gaudy or nouveau riche. Be understated, but at the same time, show respect by offering unique and special experiences and products.

Find the Right Spokesperson

"Taiwan’s luxury retail is heavily personality-driven, and consumers respond very positively to brands that select a spokesperson they respect for their taste," says Don Lin. "A recent example is the partnership between Dior and Johnny Depp, which greatly impressed local consumers, as Depp has long been wildly well-respected as a style icon."